Biweekly pay rate calculator

Email it or print it. It is possible to arrange biweekly payments which permit faster repayment and a lower loan cost.

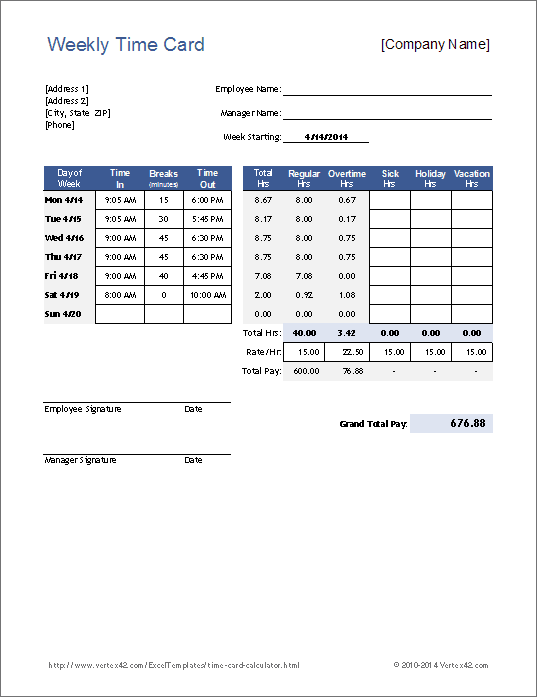

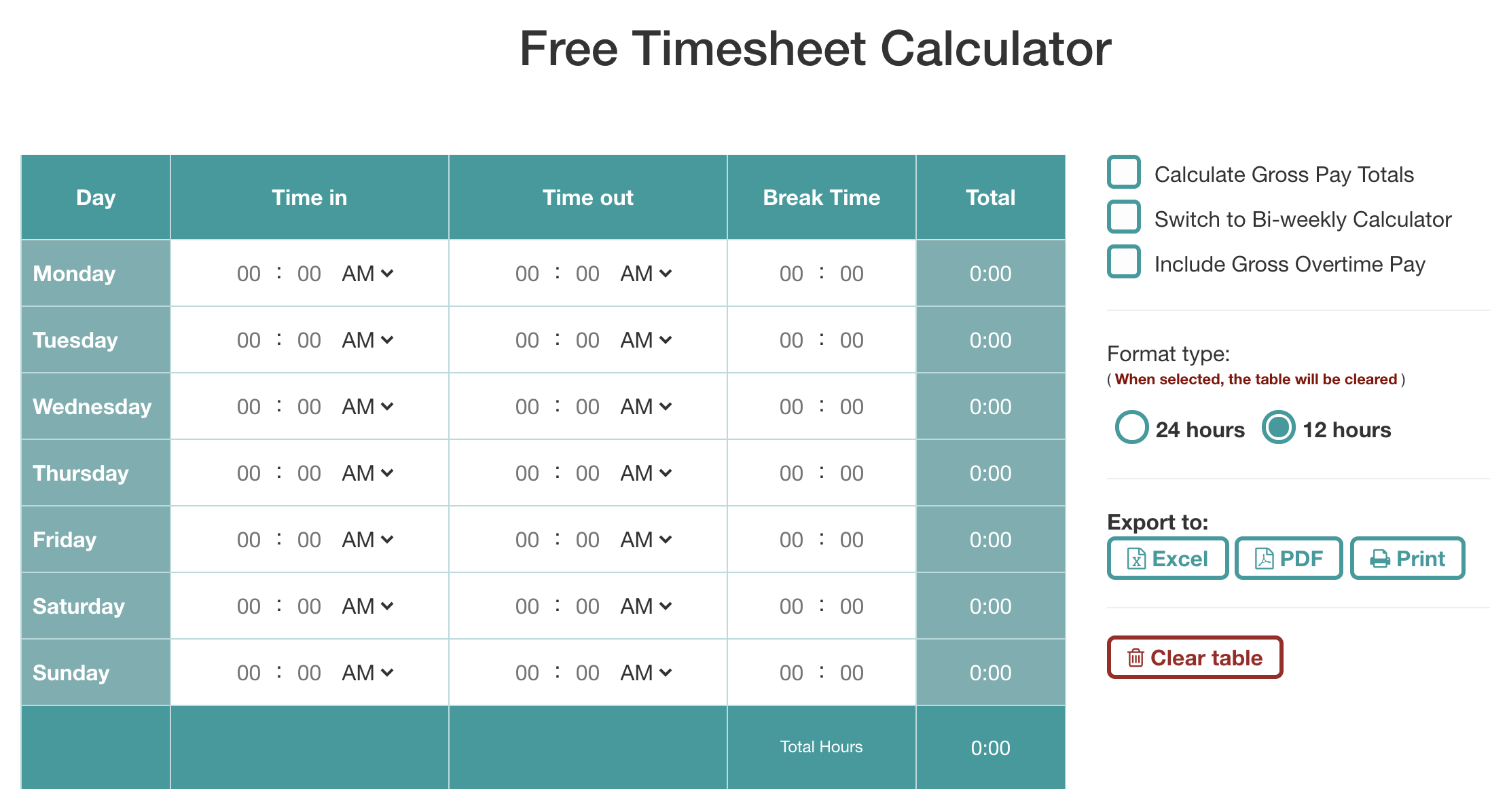

Free Time Card Calculator Timesheet Calculator For Excel

You can eliminate PMI once youve reached 20 equity in your home.

. For instance for Hourly Rate 2600 the Premium Rate at Double Time 2600 X 2 5200. The following table highlights the equivalent biweekly salary for 48-week 50-week 52-week work years. How the homeowner makes their mortgage payments can save a lot of money over the life of the loan.

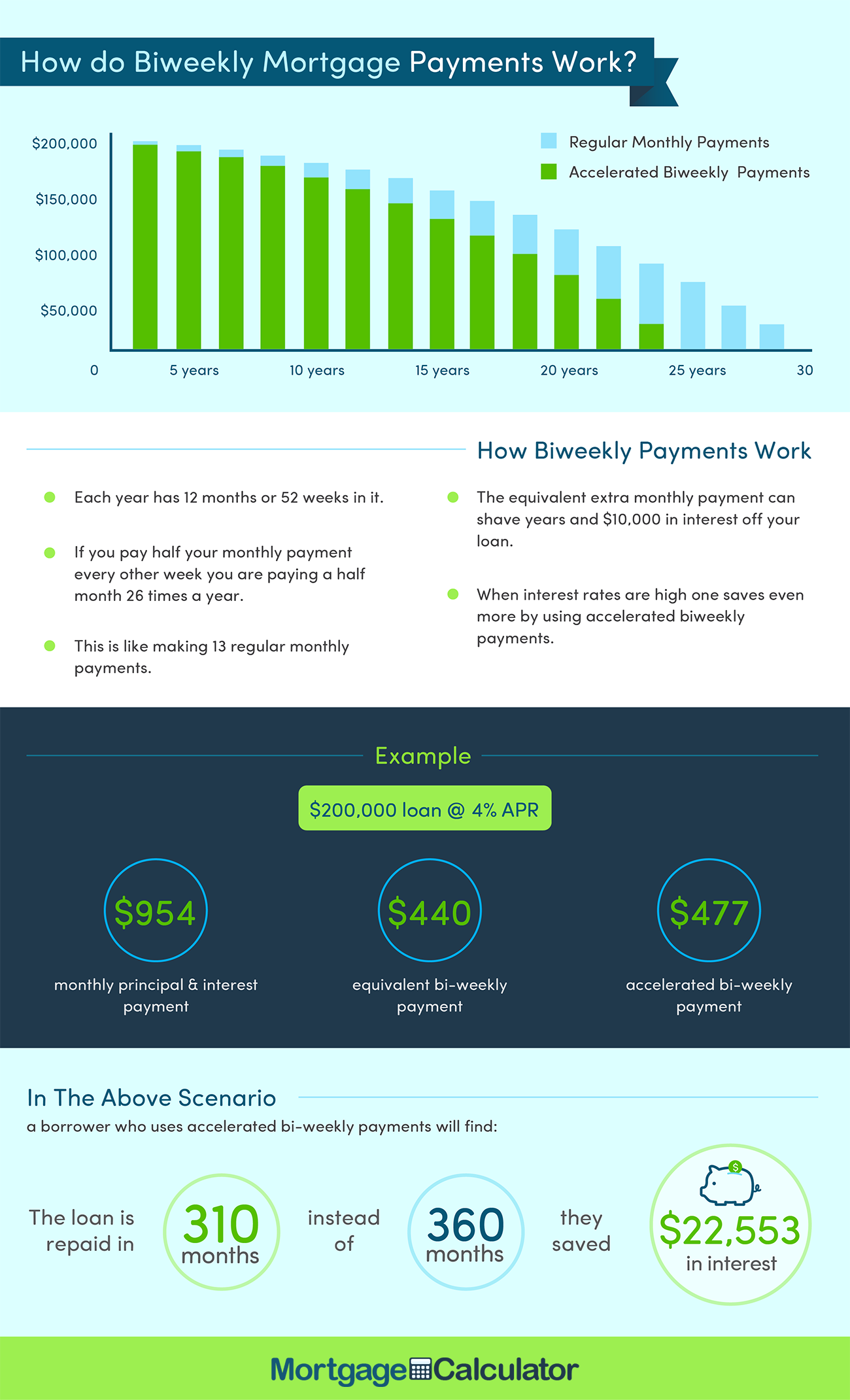

For a biweekly payment it is divided by 26 while a monthly payment is divided by 12. The monthly vs biweekly mortgage calculator will find out how much faster you can pay off your mortgage with biweekly payments and how much you will save in interest payments. To reach the best long-run outcomes for your money there are two guidelines to keep in mind as you head into the mortgage process.

Treasury yield as tracked by the Federal Reserve Board. If you work 50 weeks a year are paid ever other week then multiply those biweekly pay periods by 25 to calculate the associated annual income. Please see our bi-weekly mortgage calculator if you are using biweekly payments to make an effective 13th monthly payment.

Biweekly Mortgage Calculator. One option to consider is a biweekly every two week payment plan. Bi-weekly pay is the preferred pay method by Employers.

With biweekly mortgage payments you make 26 half-payments a year which equates to 13 total payments in a year. Divide your biweekly income by how many hours you typically work in a your typical pay period. For a biweekly payment a 30-year term is multiplied by 26 resulting in 780 payments.

For example if your monthly mortgage payment is 1000 youd pay 500 every 2 weeks instead of 1000 at. 5547a and 5 CFR 550105 General Schedule GS employees and other covered employees may receive certain types of premium pay for a biweekly pay period only to the extent that the sum of basic pay and premium pay for the pay period does not exceed the greater of the biweekly rate payable for 1 GS-15 step 10 including any. 11th District Cost of Funds Index COFI - The rate banks in the western US.

If your interest rate is 5. Saving From Bi-Weekly Home Loan Payments. See how much money you would save switching to a biweekly mortgage.

Extra Payments In The Middle of The Loan Term. If you have 2 unpaid weeks off you would take off 1 biweekly pay period. 26 paychecks instead of 52.

Put at least 10 down 20 is even better because it lets you avoid Private Mortgage Insurance and make sure your monthly payments are 25 or less of your take-home pay. It can be a good option for those wanting to contribute more money toward a. Other Pay Rate Links.

Constant maturity yield of one-year Treasury bills - The US. The latter usually has a lower interest rate. Biweekly Caps on Premium Pay.

After opening the presentation you need to click the Slide Show tab and then Start Slide Show From Beginning. Your monthly interest rate Lenders provide you an annual rate so youll need to divide that figure by 12 the number of months in a year to get the monthly rate. A biweekly payment means making a payment of one-half of the monthly payment every two weeks.

When you have a mortgage at some point you may decide to try and pay it off early. Net Pay Calculator PowerPoint Presentation Net Pay Calculator PowerPoint presentation Note for employees with PowerPoint 2007. In the event of a conflict between the information from the Pay Rate Calculator.

Less work for the payroll department. The EX-IV rate will be increased to 176300 effective the first day of the first pay period after January 1 2022. One easy way to pay off your mortgage sooner is to pay your loan on a biweekly basis instead of monthly.

Most home loans are structred as 30-year loans which is 360 monthy payments. This entry is required. N the total number of payments.

The Pay Rate Calculator is not a substitute for pay calculations in the Payroll Management System. If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the. Adding Subtracting Time.

Switch To A Biweekly Payment Schedule. It has many options that you may need such as PMI property tax home insurance monthly HOA fees and additional mortgage payment. These figures are exclusive of income tax.

Less printing andor posting cost. Enter the Hourly rate without the dollar sign. Traditionally mortgage payments are made every month.

This is a significant factor for most homeowners. PMI protects the lender from default so you should aim to eliminate. If your effective income tax rate was 25 then you would subtract 25 from each of these figures to estimate your biweekly paycheck.

Cash out debt consolidation options available. For example if your mortgage rate is 35 and your portfolio earns an average of 6 per year youd lose money by using extra funds to pay off the loan early. London Interbank Offered Rate LIBOR - The rate international banks charge one another to borrow.

Paying less interest on a mortgage lets you store that cash in an emergency fund or pay off other high-interest debt. Borrow from 8 to 30 years. Are you starting biweekly payments in a middle of a loan schedule.

Allow pop-ups to be able to print the Timesheet Calculator. Because of the EX-IV cap some GS-14 and GS-15 special pay rates are capped. 3 Key Questions to Ask.

Tens of thousands of dollars can be saved by making bi-weekly mortgage payments and enables the homeowner to pay off the mortgage almost eight years early with a savings of 23 of 30 of total interest costs. Enter an amount between 0 and 50. A 20-year loan is 240 monthly payments A 15-year loan is 180 monthly payments a 10-year loan is 120-monthly payments and 5 year loan is 60 monthly payments.

For premium rate Double Time multiply your hourly rate by 2. R the periodic interest rate. Pay less in Interest.

Pay off higher interest rate credit cards pay for college tuition. Over 170000 positive reviews with an A rating with BBB. Since you would pay 26 biweekly payments by the end of a year you would have paid the equivalent of one extra monthly payment.

Mortgage calculators can help you figure out how much home you can afford how much you should borrow and more. The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options including making one-time or periodic extra payments biweekly repayments or paying off the mortgage in full. It calculates the remaining time to pay off the difference in payoff time and interest savings for different payoff options.

This additional amount accelerates your loan payoff by going directly against your loan. You can change the payment frequency. This results in 26 payments a year instead of 24.

Hourly To Annual Salary Calculator How Much Do I Make A Year

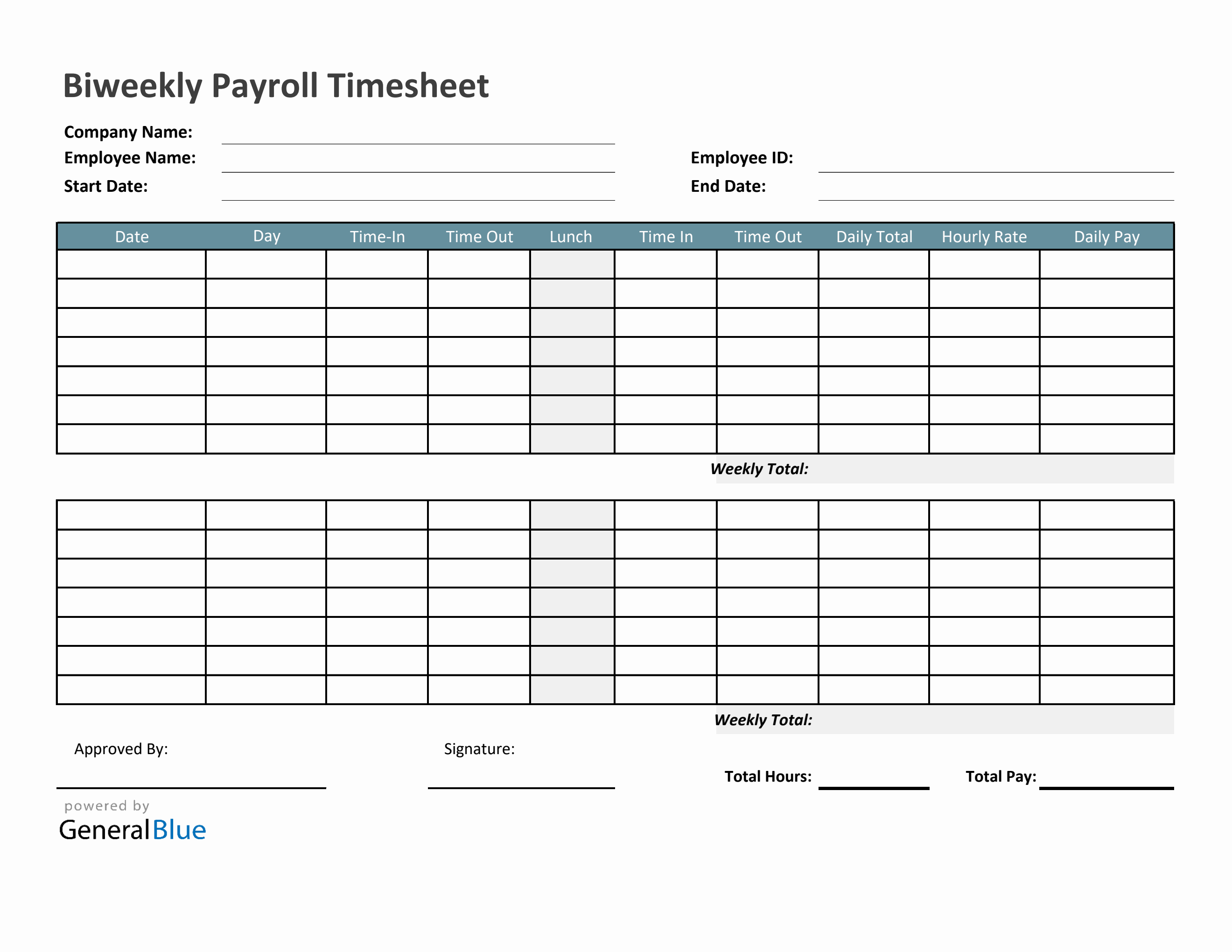

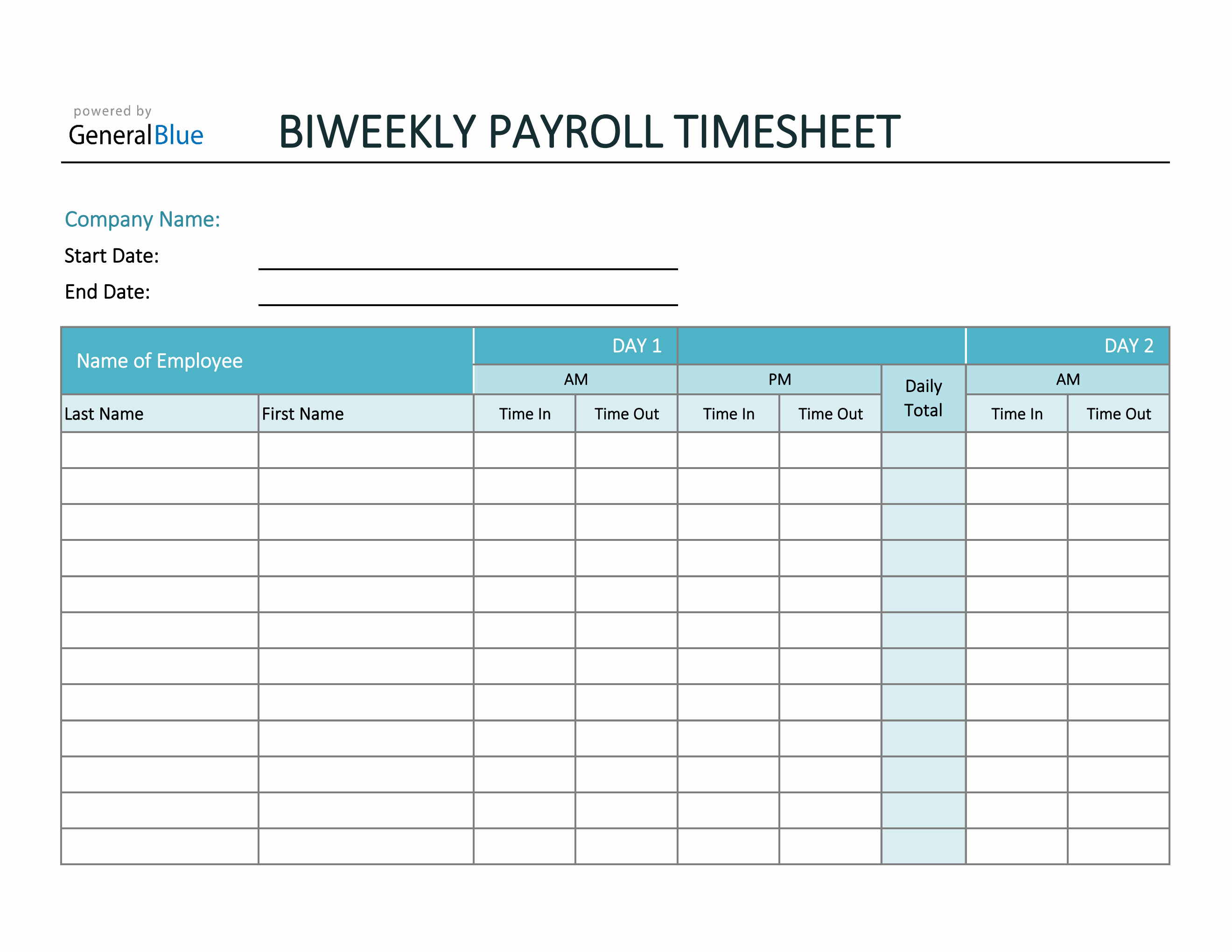

Biweekly Payroll Timesheet In Excel

Adp Paycheck Calculator Top Sellers 58 Off Www Wtashows Com

Take Home Salary Calculator Store 50 Off Www Wtashows Com

How To Calculate Monthly Income From Biweekly Paycheck Hassle Free Savings

Logwork Free Timesheet Calculator

2022 Biweekly Payroll Calendar Template For Small Businesses Hourly Inc

4 Ways To Calculate Annual Salary Wikihow

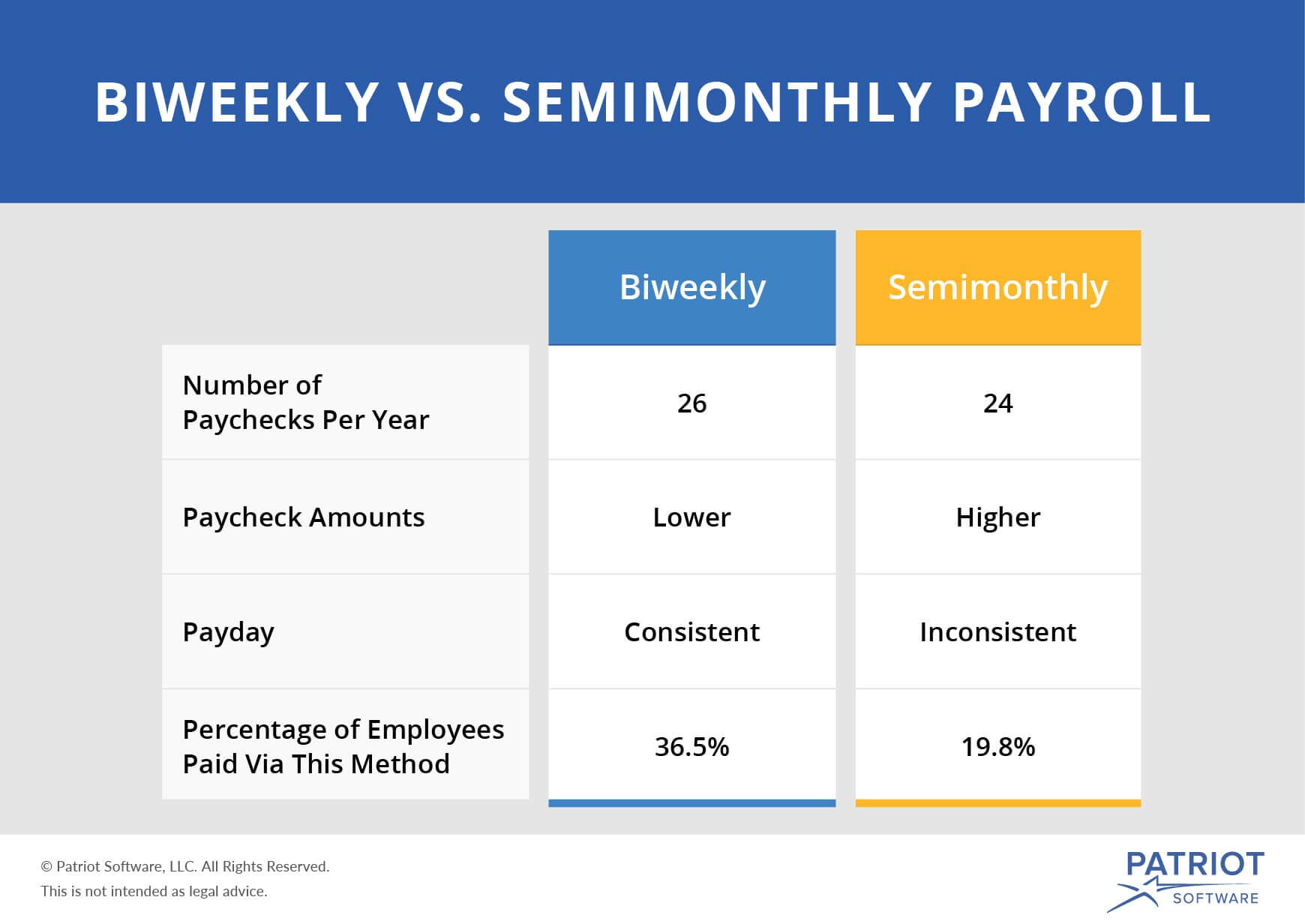

The Pros And Cons Biweekly Vs Semimonthly Payroll

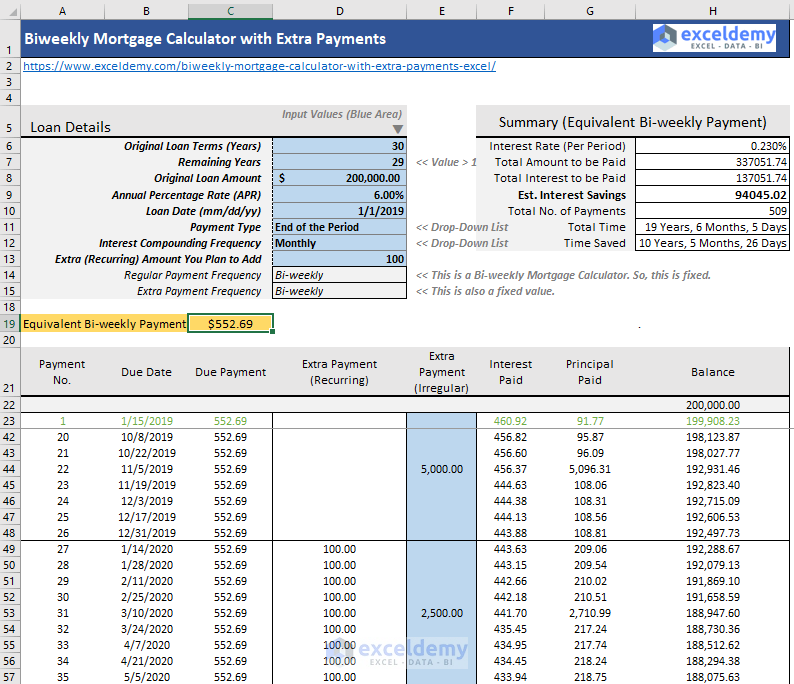

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Excel Biweekly Payroll Timesheet For Multiple Employees

Hourly Wage To Biweekly Paycheck Converter Hourly Salary Conversion Calculator

![]()

Download Free Bi Weekly Timesheet Template Replicon

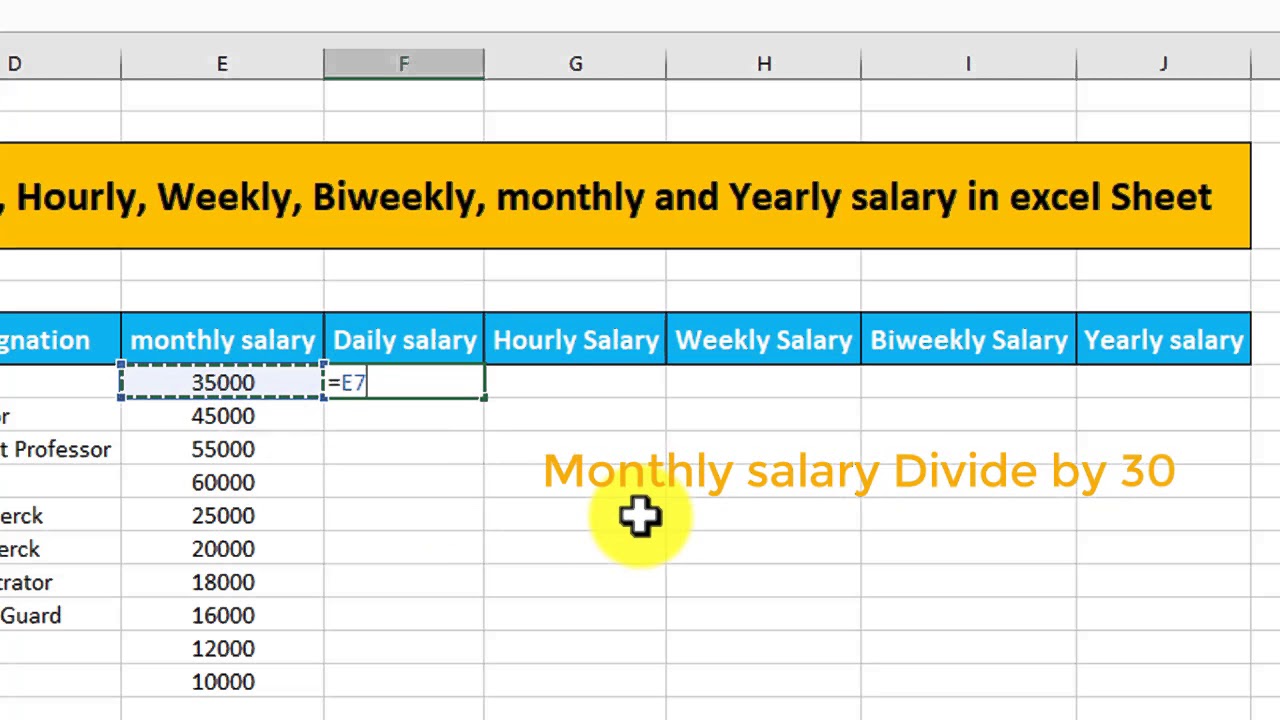

How To Calculate Daily Hourly Weekly Biweekly And Yearly Salary In Excel Sheet Youtube

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

How To Calculate Payroll Taxes Methods Examples More